However, self-employed individuals and solo business owners should consider Solopreneur—unless you have an employee, which will require an upgrade to Simple Start. This section focuses more on first-time setup and software settings. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information. Our QuickBooks Online comparison is based on our internal case study, explained below. As mentioned earlier, QuickBooks Solopreneur is excluded from our evaluation since it’s not a double-entry accounting software.

Business

You can also visit our Learn and Support page to search by topic. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe.

QuickBooks Online VS QuickBooks Desktop: 2024 Comparison

If you want cloud-based software, there’s QuickBooks Online and QuickBooks Solopreneur. If you want locally-installed software, you can take your pick from QuickBooks Pro, QuickBooks Premier, or QuickBooks Enterprise. If you read the overview of each QuickBooks product, you may already have an idea of which version of QuickBooks is best for your small business. These five questions will help you narrow down your search and find what you’re looking for. QuickBooks Mac Plus is best for small to medium-sized businesses looking for locally-installed software compatible with Macs.

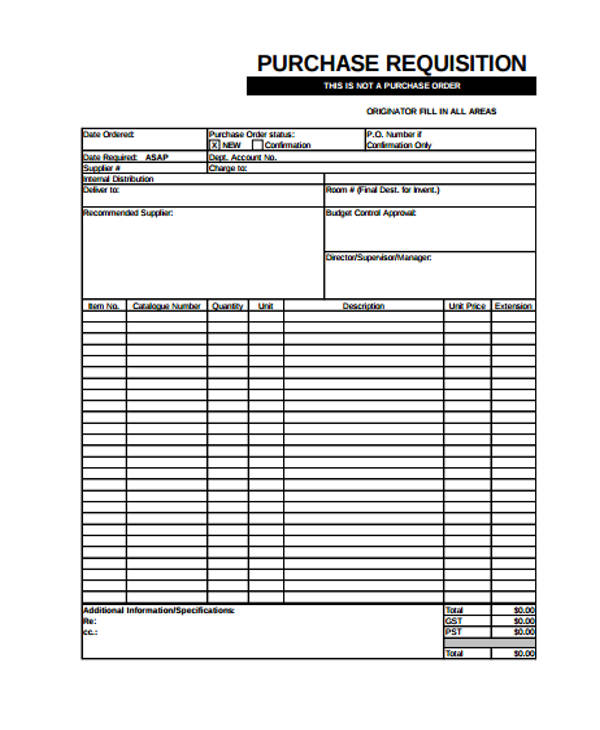

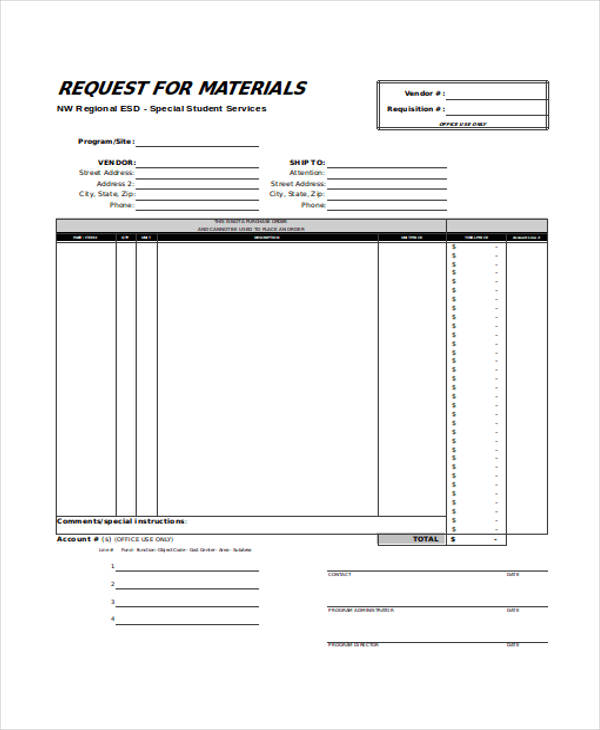

When creating POs in Plus, you can input specific items you want to purchase. When your POs are fulfilled, you can convert them to a bill easily. Our internal case study compares the four standard QuickBooks Online plans for small businesses across major accounting categories and functions to help you decide which one fits your needs. We excluded QuickBooks Solopreneur because it’s not a double-entry accounting system. If you’d like additional help, there are tutorials available on a wide range of accounting terms, skills and how-tos in our QuickBooks Tutorials section.

QuickBooks Solopreneur (formerly known as QuickBooks Self-Employed) costs $20/month or $120 for the first year. This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports. Payment gateways allow you to accept payments from your customers. Common payment processing options include PayPal, Stripe, Square, and Authorize.Net. QuickBooks Online offers around 25 payment processors, or you can use QuickBooks Payments.

- Processing fees also differ depending on the type of transaction.

- Like other QuickBooks Desktop products, pricing is no longer disclosed online.

- QuickBooks Online Advanced now offers a fixed asset accounting feature that allows you to enter and track fixed assets, such as vehicles, buildings, and equipment.

- However, if you don’t need extra features, the industry editions, or the extra users, QuickBooks Premier could be needlessly expensive.

Talk to our sales team

This makes payments more convenient, which can lead to quicker payoffs. You can set up automatic contributions or let your employees decide how much they’ll allot for it. After the initial setup, you’ll still receive regular bookkeeping support. It has everything from the Plus plan but with more integrations and customizations. For example, you can set up automatic workflows and backups for better efficiency and productivity.

Their kits are designed to work seamlessly with QuickBooks Online. So you don’t need to spend hours figuring out how to convert the data from your accounting software to your tax forms. On the other hand, the profitability tracking feature lets you view details such as labor costs, expenses, and income. So you can see where the money is coming in and out of your business. You can even set tax categories to organize them and save time during tax season.

QuickBooks Online offers an incredible number of features and automations. The software covers all the accounting bases as well as invoicing, expense tracking, accounts payable, contact management, project management, inventory, budgeting, and more. Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time. This can be useful if you have many customers who need to be invoiced for the same products or services.

It even has a batch invoicing and expense management feature, which is ideal for those who manage a large volume of invoices and expenses daily. With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. Meanwhile, Essentials gives you access to more than 40 reports, including those you can classified balance sheet financial accounting generate in Simple Start. Its additional reports include A/P and A/R aging details, transaction lists by customer, expenses by vendor, uninvoiced charges, unpaid bills, and expenses by supplier summaries. You can drill down to a list of your outstanding invoices instead of only the total outstanding.